Manufacturing

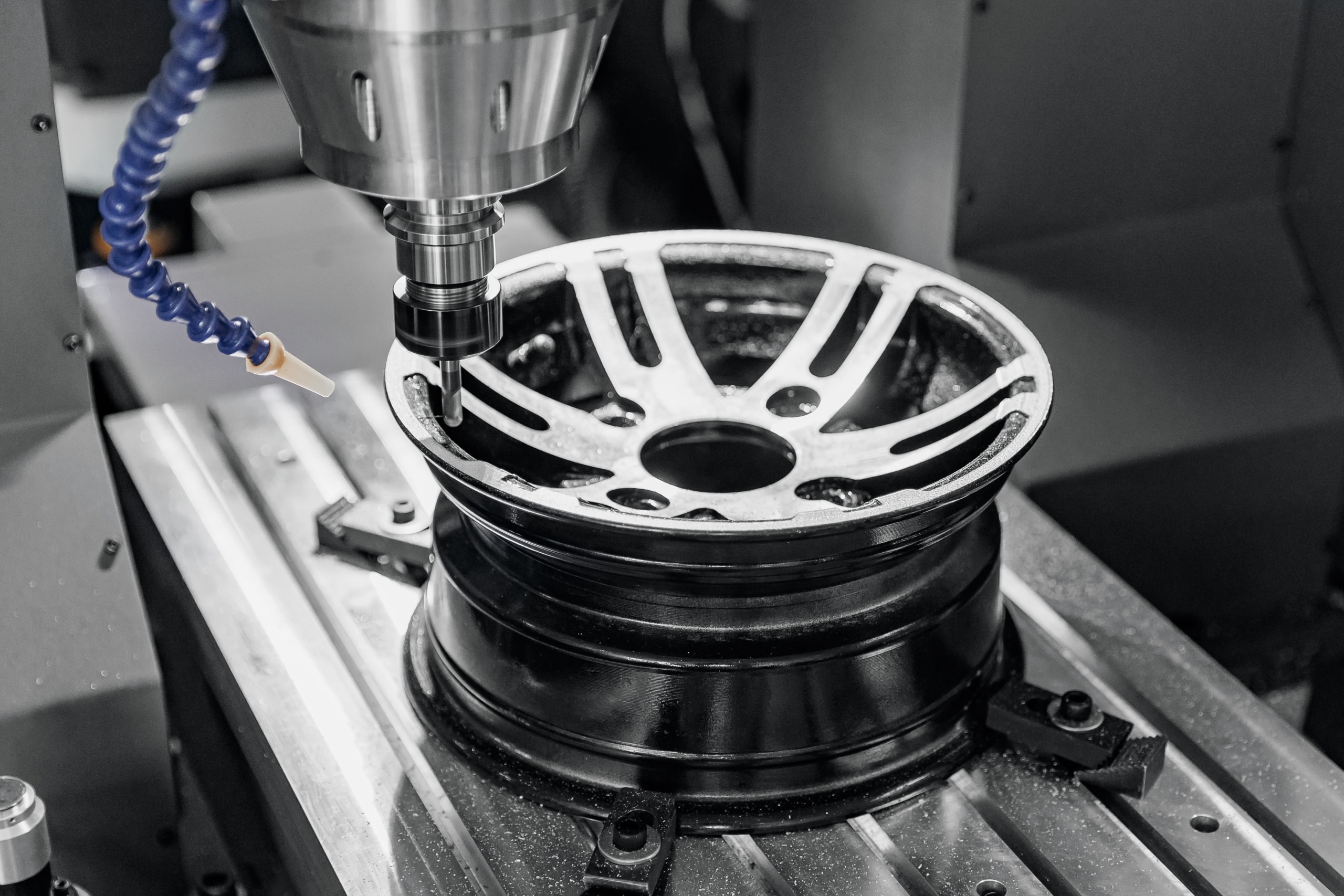

Aging equipment meets rising costs and technology disruption. We transform operations through smart factory integration, predictive maintenance, and workforce capability building.

A global leader in industrial components partnered with EFESO to address major operational, financial, and strategic challenges at one of its key Western European sites.

Industry: Industrial Manufacturing

Service: Manufacturing

Service: Restructuring & Turnaround

Service: Supply Chain

Service: Transactions and Turnaround

A global industrial components manufacturer with annual revenues in the multi-billion-euro range, operating a complex manufacturing footprint across several countries.

The company employs several thousand people worldwide and serves both traditional and emerging markets through a highly diversified product portfolio.

The engagement began as an operational improvement initiative but evolved into a full-scale restructuring as several deep-rooted challenges emerged:

Despite a highly complex environment, EFESO enabled the client to achieve full transparency on performance, costs, and options—leading to a clear, defensible strategic decision that safeguarded long-term value.

EFESO deployed a rigorous, fact-based methodology combining operational diagnostics, stakeholder engagement, and scenario modeling to guide a sensitive restructuring process.