E2E Supply Chain Ecosystem Transformation

Survey Report

Supply Chain Transformation Requires Clear Strategic Vision

Survey Methodology

The survey was conducted in Q4 2024 by EFESO Management Consultants in partnership with Supply Chain Media. It combined structured interviews and questionnaires targeting senior supply chain executives to ensure a comprehensive understanding of transformation challenges and strategies. The survey examines the current state of supply chain transformation as of 2024 and projects trends through to 2027, providing a forward- looking perspective on how companies plan to adapt to emerging challenges and opportunities.

The survey covered a wide range of industries, highlighting how supply chain transformation challenges and strategies are relevant across all sectors.

The pandemic was a catalyst for supply chains: more and more companies realized that their supply chains can make the difference, can be the competitive advantage and decisive factor. But this typically is triggered by the business strategy.

Grey Swans

So when is such a task force needed?

When answering this, Meers distinguishes between white, grey and black swans. By white swans, he means events that have been announced in advance, such as Brexit or the US elections.

‘Those are the events we can prepare for and for which we do not need a task force,’ Meers states.

‘In contrast, companies do set up task forces for grey swans: events that we know could happen one day, but which cannot be predicted. Think of pandemics, an earthquake or the escalating conflict in the Middle East. The same goes for black swans: rare events that no one could have foreseen.’

Actually, there should be no immediate need to set up a task force for all grey swans, Meers claims.

‘We know very well which regions are prone to earthquakes and which suppliers are located there. We can figure out in advance what measures to take if one of those suppliers is put out of action. By incorporating some of the processes, tools and competences of the task force into the line organization, we can handle such disruptions without setting up a special team. That helps to make the supply chain resilient.’

After disbanding the task force, Bosch did indeed integrate a number of processes and methodologies into the line organization.

‘Now, when we see that the availability of certain raw materials or components is coming under pressure, we try to secure supply with long-term contracts. Or we try to redesign our products featuring components that are available in sufficient quantities.’

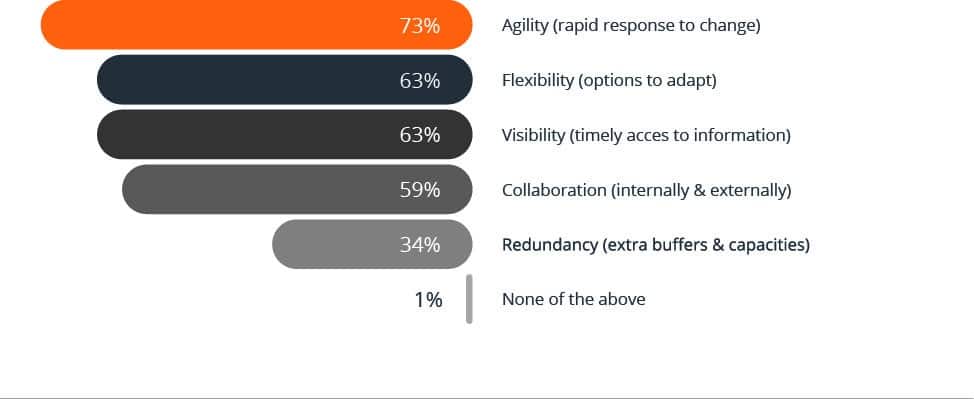

Which capabilities for resilience are important for your transformation?

Collaboration is the Key to Success

Due to geopolitical conflicts, new trade barriers and climate change, the number of grey and black swans has increased significantly in recent years. Like Bosch, many companies have been forced to embark on a transformation and improve their supply chain resilience.

That transformation is not just limited to their own organization, but extends to the entire ecosystem in which they operate. ‘Many supply chain leaders realize that they need to look beyond the four walls of their own company, towards suppliers, customers and other supply chain partners. How can they get a better view of everything happening in the ecosystem that impacts their own supply chain?,’ says Kristof De Coster, Partner and Supply Chain Lead at consulting firm EFESO.

Such companies regularly approach EFESO, asking how to set up such a transformation. ‘Ecosystem transformation is the next step towards a more mature supply chain,’ De Coster comments.

‘But we see many companies struggling with this transformation. Apparently, there are all kinds of factors or circumstances that prevent companies from taking the next step. We want to know what they are. That was the reason for us, together with Supply Chain Media, to ask almost a hundred supply chain executives about their experiences with supply chain ecosystem transformations.’

Which collaboration types are most important for your transformation?

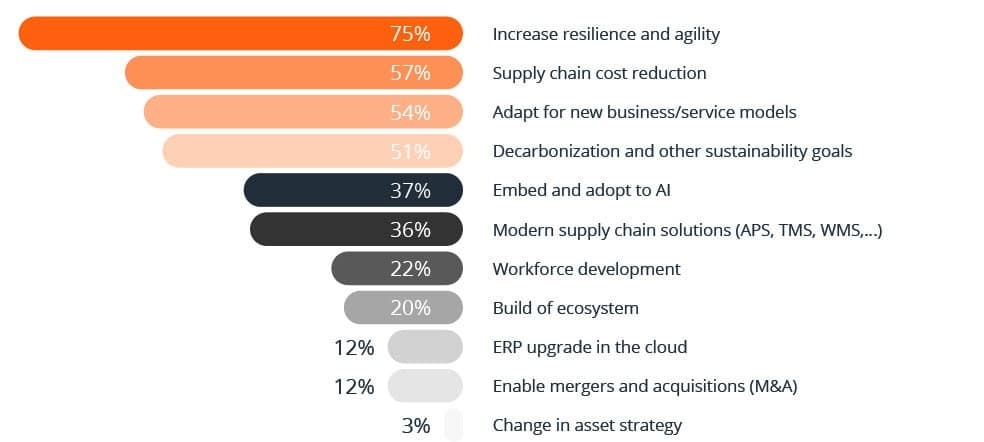

Increase Resilience and Agility

One of the first survey questions concerns the goal companies have in mind with their transformation. Most executives mention increasing resilience and agility, followed by reducing costs. De Coster is not surprised by these answers, but stresses that it is difficult to reconcile both goals.

‘Increasing agility requires more flexibility in the supply chain, and that comes at a price,’ he states. ‘And those who improve their resilience to hedge against increasing risks are effectively paying an insurance premium for it. During the pandemic, everyone accepted that insurance premium because they had to survive. Now it appears that many companies cannot afford to keep paying that premium year after year. Different measures are called for.’

The survey reveals that companies with a mature supply chain are much more likely to cite adapting to new business models as their main goal. These companies think and act a lot more offensively than companies with low maturity.

‘Companies with a mature supply chain are better armed against disruptions,’ says De Coster.

‘But we see many companies struggling with this transformation. Apparently, there are all kinds of factors or circumstances that prevent companies from taking the next step. We want to know what they are. That was the reason for us, together with Supply Chain Media, to ask almost a hundred supply chain executives about their experiences with supply chain ecosystem transformations.’

What will be the main goals to transform supply chains in the coming years?

Supply Chain Now Sits in the Boardroom

One of the respondents is Maria Pia De Caro, Executive Vice President Global Operations & Sustainability at Pernod Ricard. Like De Coster, she sees companies struggling with transformations.

‘In the period before the pandemic, we could divide companies into two categories: those that saw supply chain as a value creation opportunity, and those that saw supply chain as a kind of utility. That changed during the pandemic, and suddenly we all became heroes. From one day to the next, we were sitting in the boardroom and being asked for advice.’

Although the immediate crisis has passed, the need for transformation remains. Companies with mature, integrated supply chains, which they had been working on for years before the pandemic, continue to evolve.

‘But for companies that have not invested in their supply chains, starting a transformation is a lot harder. The supply chain executives at these companies realize that investment is necessary to maintain competitiveness, but don’t know where to start. And they don’t know how to convince the other board members of the urgency, especially now that their attention has shifted to other commercial priorities.’

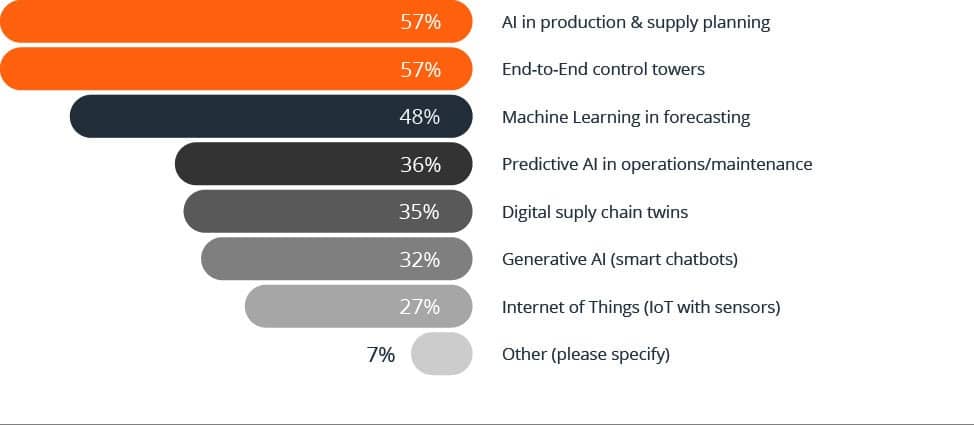

Digital and AI Tools for Transformation

The transformation within Pernod Ricard is focused on further supply chain integration and strengthening resilience. In particular, the wine and spirits producer is focusing on production.

‘We need to look at production from the perspective of our ecosystem, and find the right balance between global, regional and local production. We have already made considerable progress in the area of sourcing, which is now organized globally,’ De Caro states.

The need for transformation is a consequence of the aforementioned grey and black swans.

‘We face instability in our supply chains and must be prepared to respond quickly to disruptions. We have invested in IBP processes and one-number planning for years, but that is no longer enough. Today, I prefer working with scenarios rather than a single number.

To respond adequately to new developments, I need two or three executable scenarios and a fully integrated supply chain, which makes smart use of artificial intelligence.’

De Caro refers to the port strikes on the east coast of the United States.

‘When something like that happens, you have to explore different options at lightning speed – especially if you need to cut costs, generate cash and are struggling with a talent shortage. That’s when all the previous investments in a strong integrated supply chain pay off.’

Which digital and AI tools are most important for your transformation?

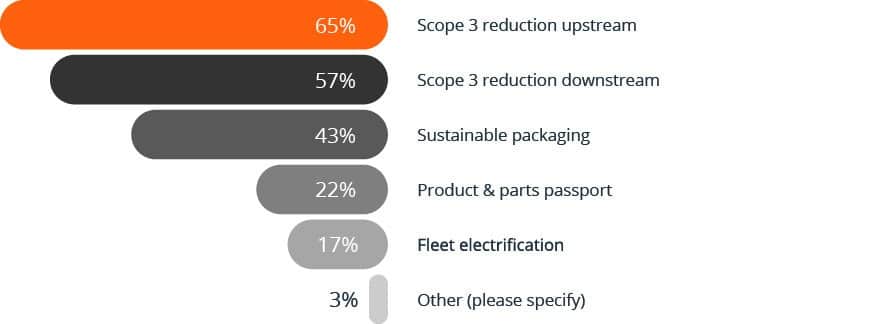

Up and Downstream Scope 3 Reduction

Chemical company Covestro has gone through a transformation in which the focus was also on further supply chain integration.

‘We now have one organization in Europe that is responsible for all supply chain-related activities including customer service, logistics, credit management and trade compliance,’ says Hanno Brümmer, who is responsible for Covestro’s supply chain and logistics in Europe, the Middle East, Africa and Latin America.

Brümmer explains that just a couple of product groups account for the largest volumes within Covestro’s chemical product portfolio.

Our focus is on polyurethanes and polycarbonates in liquid and solid form, which we supply in drums or bags, for example. For that, we only need one supply chain with one network of warehouses. Thanks to the transformation, we now have one uniform supply chain for all divisions.’

Another reason for transformation is the move towards circular business models. For a long time, the company used almost exclusively fossil raw materials, but in recent years the focus has been shifting increasingly towards bio-based and recycled materials.

‘We are now developing our own processes to use those materials as raw materials. For instance, we are able to convert the foam from old mattresses back into its original components through chemical recycling. We can also turn old car tyres back into raw materials for completely different plastic products. These kinds of processes considerably increase the complexity, and our ecosystem is growing.’

Which sustainability goals are most important for your transformation?

Decoupling for Resilience: Strategy to Transformation

It comes as no surprise to Brümmer that increasing resilience is the main reason for supply chain transformation.

‘That’s why we are in the process of decoupling our supply chain. We are determined to increase the use of rail freight in Europe, but we also know that the reliability of the railways leaves a lot to be desired, whether due to engineering works, strikes or driver shortages. Therefore, we have split our supply chain. We use rail transport to hold stock closer to customers. Then, when a customer places an order, we can deliver it by road within one or two days. That means we are not impacted by problems on the railways.’

Of course, it is always important to keep a grip on costs, according to Brümmer.

‘But I would not say that we are in a phase of intense cost cutting. We are trying to operate more cost-efficiently through network optimization, but eliminating as much cost as possible from the supply chain is not an end in itself at the moment.’

More Production Capacity

The transformation underway within dsm-firmenich is the result of the merger that took effect a year and a half ago. dsm-firmenich is strong in food ingredients such as enzymes that help food producers increase productivity, for example. dsm-firmenich’s operations include a division that develops new flavours on behalf of those same food producers.

‘We have merged those activities into the Taste, Texture & Health division, which suddenly makes us a one-stop shop,’ says Richard Oosterhoff, who is responsible for the operation of this division.

The transformation has already yielded its first concrete results. The company is experiencing a growth spurt, which means the factories are even fuller and delivery reliability is under pressure. That is why Oosterhoff wants to invest heavily in expanding production capacity, but it will take some time to achieve.

‘Right at the start, we merged the supply chain organizations of both companies, with dsm-firmenich bringing in its industrial mindset. As a result, we have been able to increase the production capacity of the Firmenich plants by 10% and sometimes even 20%.’

A fully integrated supply chain is out of the question for now, Oosterhoff says.

‘We do as much as possible together. For instance, we now have a joint team working on implementing new technologies and building new production lines. However, both organizations still have their own ERP systems, which we cannot link. Of course, in the long term, we want to move towards a single platform that allows us to serve our customers even better. But it will be another four or five years before that happens.’

Get the Right Priorities and Secure Budgets

For Oosterhoff, it is unthinkable that companies struggle with an unclear business or supply chain strategy and – perhaps as a result of that – an unclear transformation plan.

‘Take Firmenich’s former organization, in which Supply Chain operated as an independent silo. Of course, within such a silo it is possible to optimize certain processes, but as a supply chain organization, your strategy cannot be separate from the business strategy. Ultimately, we as Supply Chain are judged on the success of the business. Moreover, many transformations fail because of a lack of commitment. We have very few problems with this, precisely because our transformation is linked to the business strategy.’

So what is a big obstacle within dsm-firmenich?

‘At the end of the day, it’s just the budget. We have to achieve certain financial results to finance our plans, whether that involves building new production sites, implementing a new ERP system or launching another optimization programme.

The other big hurdle concerns the combination of people and competences, especially in the field of digitalization. For example, our customers want to be able to see at any time when they can expect their order. We cannot lag behind in that. It is difficult to find enough people for these kinds of projects and to secure the necessary competences in the organization.’

What are possible hurdles delaying transformation and change?

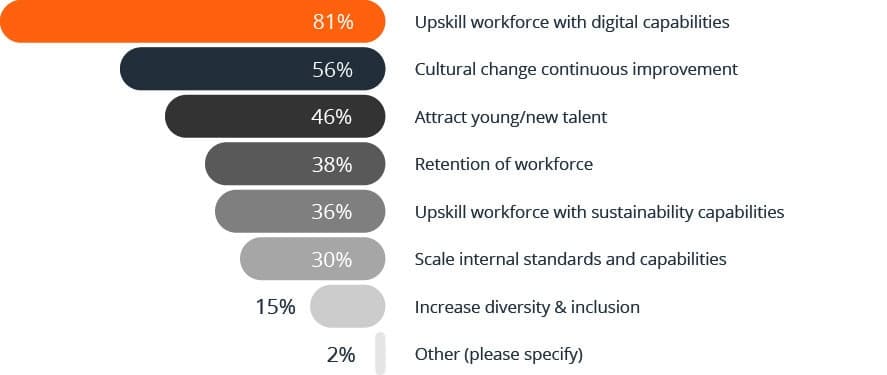

Time to Get in Shape With the Right Capabilities

Similarly, budget is a major obstacle for Pernod Ricard. ‘Economic conditions are challenging, so we are seeing volumes level off. As a result, costs and cash are under pressure. This can slow down transformation, as it requires investment. In that case, it is important to set up transformations that finance themselves,’ explains De Caro.

In such circumstances, the trick is to convince the board members of the need for transformation. ‘That takes leadership,’ states De Caro.

‘A supply chain executive must be not only a functional expert, but also a business leader. You only convince the board by speaking their language and demonstrating how the necessary transformation contributes to their objectives. So I have to speak the language of the marketing leader, the sales leader, the finance leader. The fact is that most of us are not trained in that.’

Behind the scenes, supply chain leaders should also act as designers. ‘If you are in a situation in which the supply chain needs to be adapted, you need to be able to visualize how it should look and understand what it will take to achieve that. Many supply chain leaders are very good at running existing supply chains but struggle with adapting them. The capability to redesign the supply chain is very important.’

Which human dynamics are most important for your transformation?

Legislation and Regulations

At Covestro, the limited degree of digitalization is seen as an obstacle.

‘This is a topic that is finally also gaining momentum in the chemical industry. We can still gain a lot by using digital tools for supply chain visibility. Because dangerous goods are involved, it is important to have insight into their transport. However, this is not as easy as when transporting parcels,’ says Brümmer.

He believes he knows why the chemical industry is lagging behind: ‘Because logistics service providers are quite conservative, for obvious reasons. But also because the number of logistics service providers specializing in logistics is limited, partly because of strict regulations.’

As another obstacle, Brümmer mentions the huge amount of new legislation and regulations, especially in Europe. ‘That makes things very complex if you want to invest or digitalize. Look at what we have to do before we can start producing or transporting.’

Multiple other respondents cite increased legislation and regulations in Europe as an obstacle. ‘That does not surprise me,’ says De Coster.

‘The general impression is that Europe is putting itself in a difficult position with all the regulations. It is noble that the European bloc wants to lead the way on sustainability, but if a very strong American bloc and a strong Chinese bloc think differently, it is not good for competitiveness.

Some global companies foresee their production facilities in Europe becoming unusable within a few years. Which region do you think they will invest in? In a highly regulated region like Europe, or in a region where things are a bit easier?’

Make the Change Digestible for the Organization

Above all, Meers emphasizes that the necessary measures must be digestible for the organization. As an example, he says:

‘Because of geopolitical developments, it may be worth decentralizing a supply chain and manufacturing regionally instead of globally. Then, we can increase the manufacturing flexibility by having products for one region manufactured in another region, but that is not feasible for every product. The effort required to adjust production sites accordingly is not digestible. It is not outweighed by the extra resilience we create by doing so.’

A second obstacle concerns the solidity of the measures, which requires vision and long-term commitment from the highest level.

‘Recent years have shown how important a resilient and agile supply chain is for the organization’s turnover and costs. But what if the world is a little less turbulent for a while, and sales and profits are under pressure? Will we then start cutting costs again at the expense of the accumulated resilience? In transforming into a resilient organization, we have started down a path that we must stay on in the future too.’

Be Clear on Supply Chain Vision and Ensure Right Support

On the topic of the key success factors for transformation, clarity of vision and strategy scores the highest. A lack of this already emerged as one of the main obstacles.

‘Perhaps there are too few visionaries in supply chain. Or at least too few leaders who dare to take risks and implement innovative ideas,’ De Coster suggests.

‘Most people in operations mainly do their best to make sure nothing goes wrong. They are reactive and do what is asked of them. But transformation requires vision and leadership; a proactive attitude and the guts to take risks. The companies that do have that are the ones who have made supply chain important within their business and have a mature supply chain. These are the companies that know which way they want to go, create the necessary structure, and support the business. But the majority of companies have not reached that point.’

So what is the main conclusion based on the survey, according to De Coster?

‘That many companies seem to be conflicted. On the one hand, they are waiting for a clear business strategy so that they can make the right decisions regarding the transformation they want to start. They should keep asking for that but, above all, they should not wait for all the answers to be handed to them. They need to start building a resilient and agile supply chain that can keep pace with a changing business strategy.

Even without knowing the exact business strategy, they can already take action. If you don’t start doing that right away, it will eventually result in a worse competitive position.’

Which success factors were most important in previous transformations?

Watch the video

Contributors

Executive Vice President, Head of Supply Chain & Logistics EMEA and Latin America

Senior Vice President Operations at dsm-firmenich Taste, Texture & Health

Explore the Survey Report