Transformed Europe's second-largest port into climate-neutral hub while increasing throughput and securing substantial EU funding.

Discover how EFESO works side by side with clients across industries to achieve measurable, lasting impact. Each story captures the challenges our clients faced, the actions we took together – from boardroom to shop floor – and the tangible operational and financial results delivered.

Transformed Europe's second-largest port into climate-neutral hub while increasing throughput and securing substantial EU funding.

An eight year journey hardwired a common way of thinking and working into the organization, enabling Bell Food Group to sustain delivery performance above 98.5% despite rising costs and market complexity.

EFESO conducted a feasibility study for a new 10,000-pallet automated warehouse in Romania, optimizing logistics design, layout, and CAPEX to enable scalable, efficient pharmaceutical distribution.

EFESO implemented a global award-based operational excellence program for a leading automotive OEM, boosting productivity, cost efficiency, employee engagement, and sustainability across the factory network.

A major refinery embed lean practices, improve operational performance, and strengthen cultural engagement, generating significant financial and organizational impact.

A mid-sized European automotive supplier develop a robust cost model and uncover savings for a high-voltage battery module, strengthening internal alignment and negotiation readiness.

EFESO supported a major cosmetics supplier in redesigning operations across six factories and optimizing the supply chain, targeting improved productivity and long-term profitability.

A mid-sized pharmaceutical company achieved measurable efficiency, cost, and delivery improvements at four European sites through EFESO’s Operational Excellence and Digital Transformation programs.

A leading bicycle manufacturer's shift from a supplier-driven model to a customer-centric operating model.

Creating a solid, structured plan for the material flow of its production and validated the static forecast, enabling the factory to increase the output with the existing machinery.

A QC lab optimization framework helps a multinational chemical-pharmaceutical company achieved simultaneous gains in productivity, service level, and resource efficiency, delivering measurable improvements in release time, productivity, and FTE requirements without compromising quality.

Design and implementation of a 10-year strategy targeting 4% annual growth for a world-leading luxury group, focused on aligning operations.

Creating a solid, structured plan for the material flow of its production and validated the static forecast, enabling the factory to increase the output with the existing machinery.

An international food group partnered with EFESO to redesign iconic products through a structured Redesign to Value program.

A global technology manufacturer partnered with EFESO to gain cost transparency, identify savings opportunities, and strengthen cross-functional alignment through a comprehensive cost engineering program.

Fact-based restructuring of a complex industrial site, enabling a clear shutdown decision, cash-drain elimination, and a structured roadmap for execution.

A leading global manufacturer of glass containers reduce capital expenditure by 40% in the commercialization of a new glass production technology by applying Value Engineering and Lean Product Development principles.

Reengineered Order Management processes for pharma services provider, achieving 30% OTIF improvement to 95% target.

Global packaging manufacturer deploys WCOM™ across 24 plants, slashing claims and waste 50% while boosting productivity 30%.

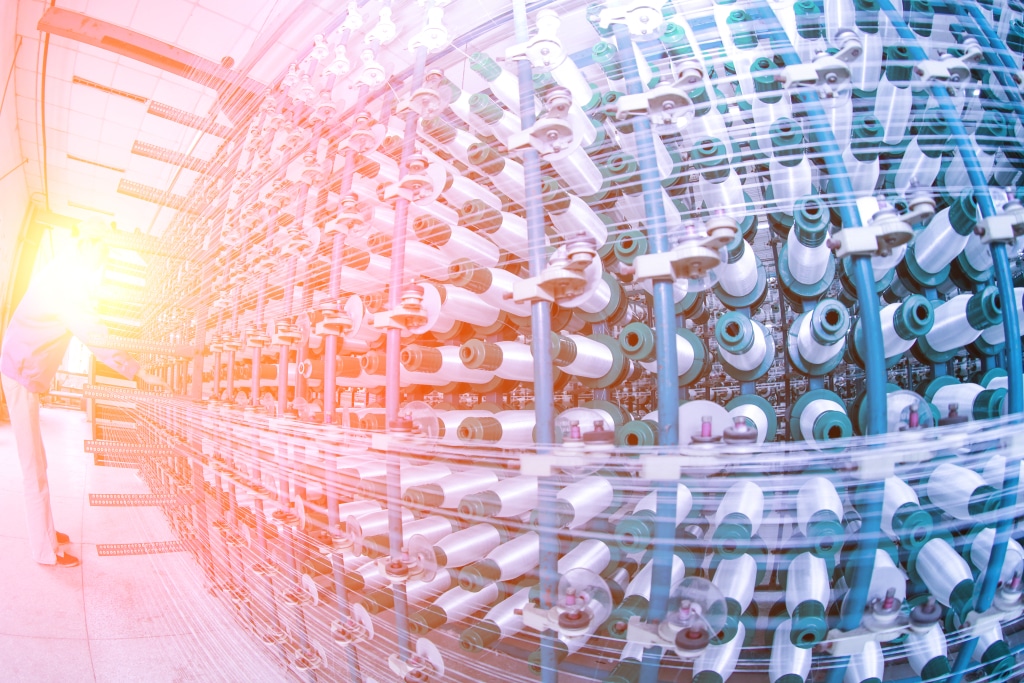

Global cosmetics manufacturer implements WCOM™ across 29 plants, achieving 20% capacity gain and 70% OEE.

Board manufacturer increased production capacity through WCOM™ implementation, achieving 8.3% OEE improvement in three months.

An initiative that improved Line OEE by 25 percentage points and positioned the organization to recover a $15M investment within 18 months.

Harmonized maintenance across 17 global sites through 50 trained change agents, delivering €50M annualized savings.

Global packaging manufacturer implements TPM across lighthouse plants, achieving 1m€ run-rate savings through 30 improvement teams.

Discover measurable outcomes achieved with our clients

See how transformation happens, from boardroom to shop floor

Let’s discuss how we can deliver similar impact for you